In 2023, the hotel industry was shaped by steady recovery following the crisis and continued interest in innovative technology. Discover more about these developments in the DACH region, their underlying factors and the evolving role of technology.

2023 was an exciting year for the hotel industry.

When it comes to demand and willingness to pay, the days of crisis appear to be largely behind us. Investment in innovative technology is also in full swing in many places.

Marco Baurdoux and Elisha Schoppig of Hotel-Spider explore these changes in more detail in this German livestream, sharing the latest studies, facts and figures on the industry’ comeback and some exciting insights into the topic of technology adoption and hoteliers' current priorities.

We have summarized the most important points for you here.

Utilization and demand since the pandemic – how have they developed and why?

Complete industry comeback in 2023

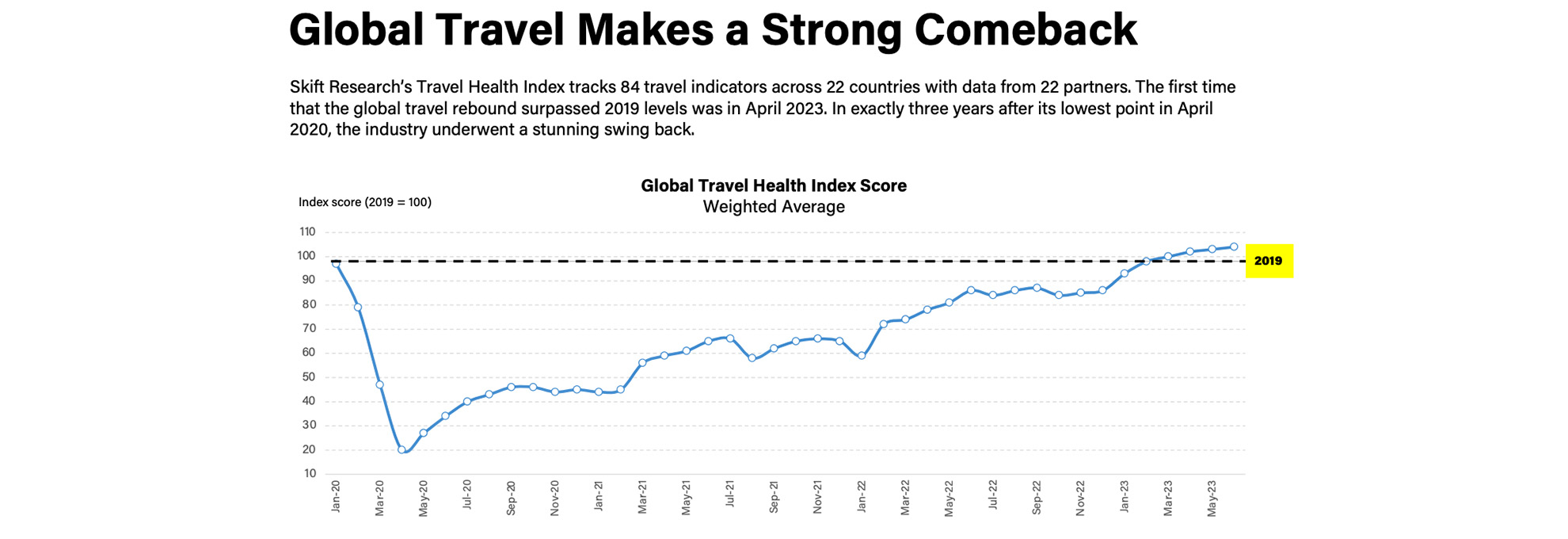

According to data from the Skift Travel Health Index 2023, the global accommodation sector returned to 2019 levels in February 2023 for the first time in terms of both demand and room pricing. In April 2023, exactly three years after the lowest point of the pandemic, the industry was even able to exceed the 2019 values. Considering how hard our industry has been hit, this is a remarkable development.

Development of the global hotel industry between January 2020 and May 2023.

Industry development in Switzerland and Germany

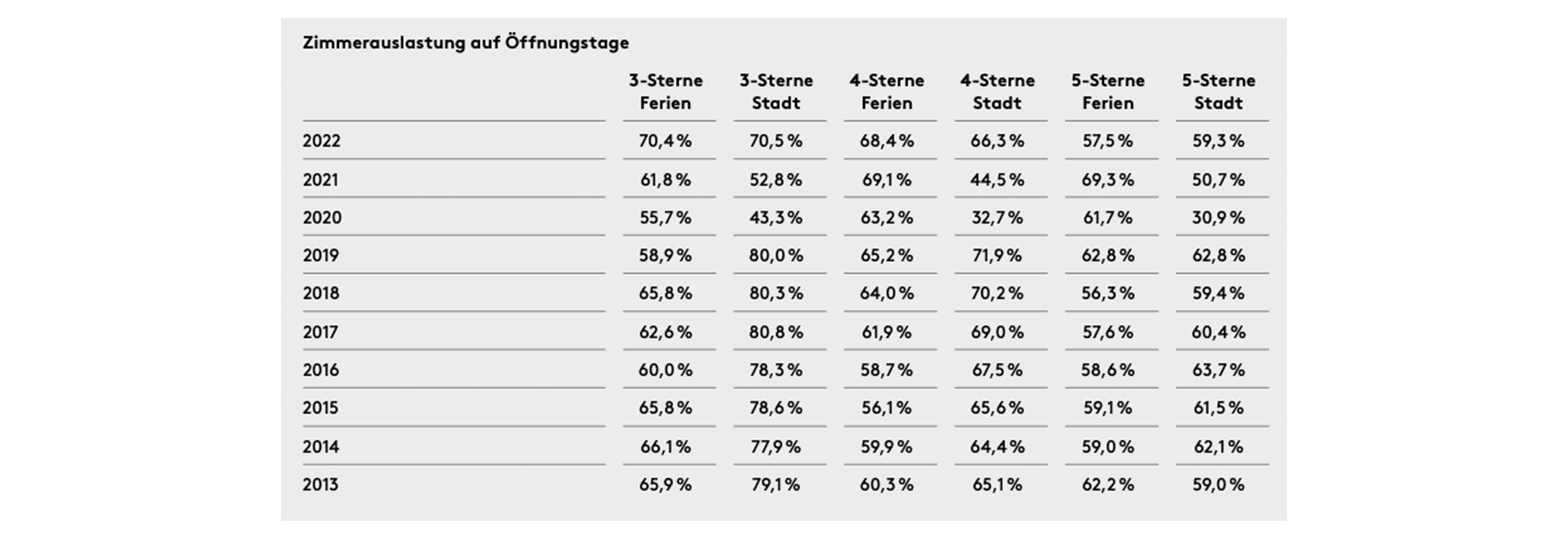

Both countries are experiencing a similar upward trend in line with the global market. Notably, strong local demand partially offset the absence of international travelers in 2020. This particularly benefited holiday-orientated hotels. City hotels faced greater challenges during the pandemic despite local demand.

An interesting point to note is the declining demand for 5-star establishments from 2021 to 2022. Marco suggests a possible explanation: “During the pandemic, guests wanted to treat themselves more often. They couldn't go on long trips, so they opted for upscale hotels in this country. Now that the borders are open again, many people are heading back abroad. Meanwhile, international arrivals in Switzerland have not yet fully recovered, But that’s on the horizon.”

Average room occupancy in Swiss hotels from 2013 to 2022.

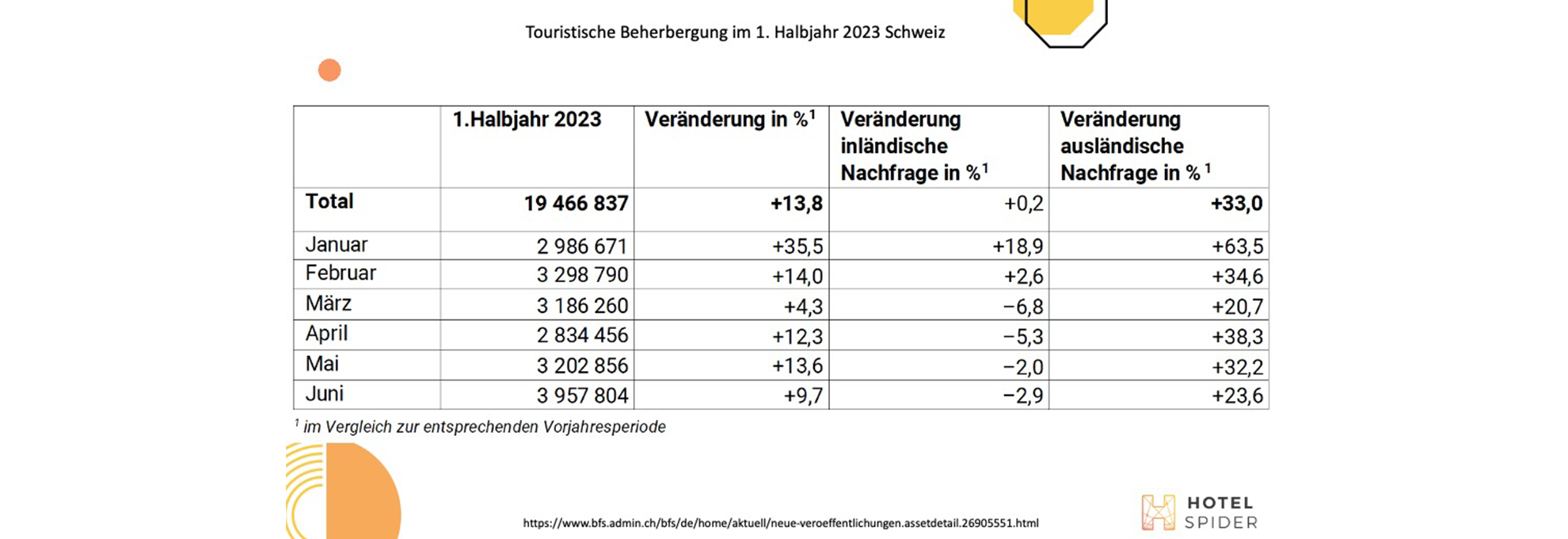

Overall, the Swiss hotel industry recorded strong overall development, especially from 2022 to 2023. During this time, the number of overnight stays increased by a total of 13.8%. This was primarily due to the fact that foreign demand increased by 33%.

Development of the number of overnight stays in Switzerland from 2022 to 2023.

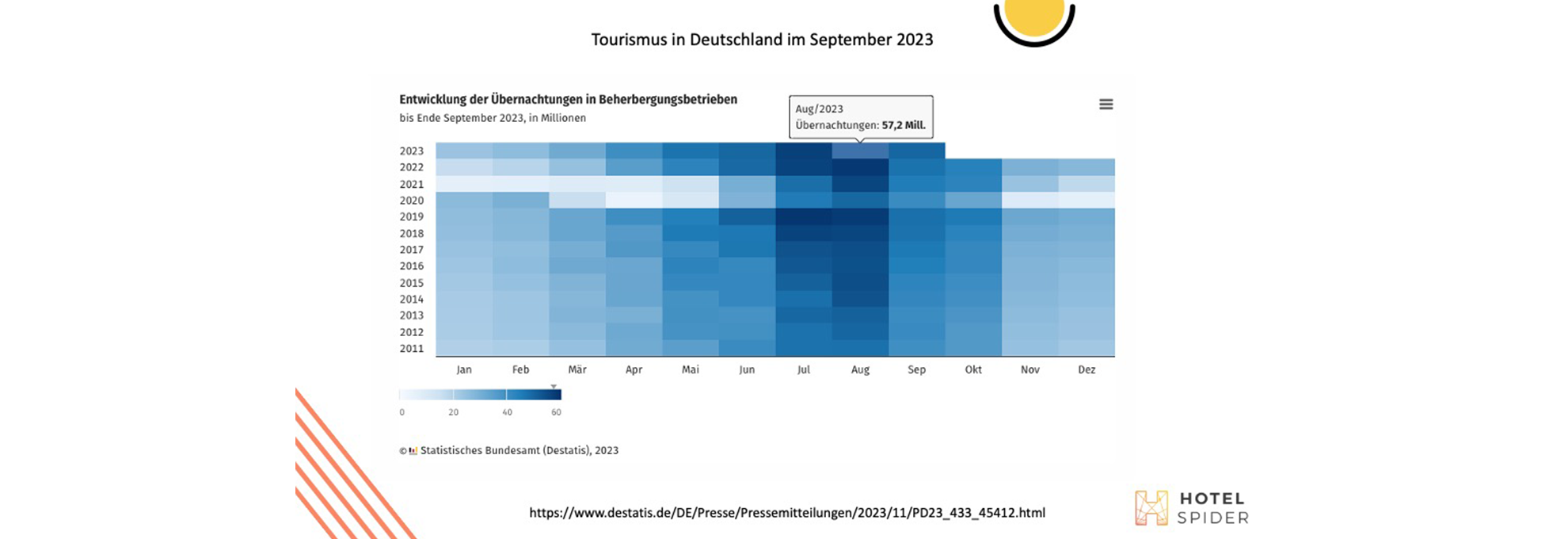

The development was similar in Germany. According to the German Federal Statistical Office, strong domestic demand in 2020 ensured at least relatively solid summer months, particularly benefiting holiday-orientated hotels.

The city hotel industry faced a slower recovery. This was mainly due to the fact that, according to the Association of the German Trade Fair Industry (AUMA), it wasn't until 2023 that the full trade fair program resumed. The normalization of international business travel was also delayed until 2023.

Development of overnight stays in Germany from 2011 to 2023.

Technology in the hotel industry: What solutions are hotels using today?

Technology adoption in the hotel industry has been progressing for quite some time. Here is a snapshot of the current situation.

The most widely used technology applications in hotels

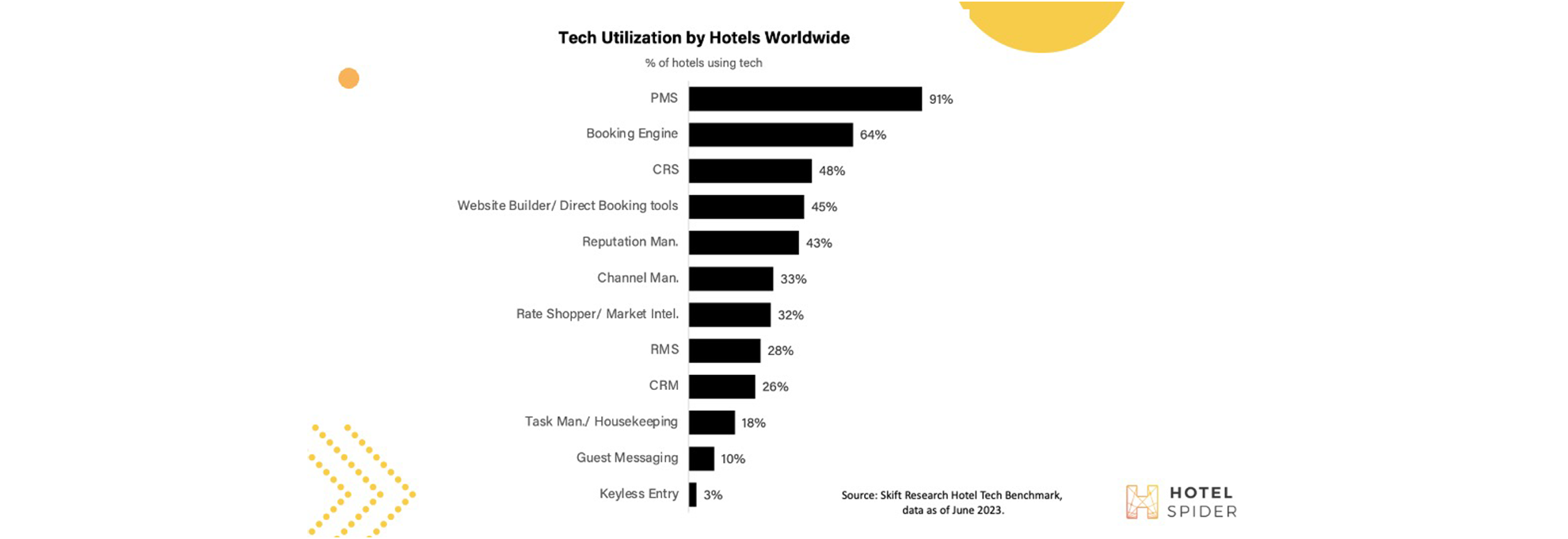

It probably comes as no surprise that property management systems (PMS) are the most widely used solution in our industry. According to Skift, 91% of hotels use them.

Booking engines are also in high demand at 64%, followed by central reservation systems (CRS) at 48%. “It may seem surprising at first glance that less than half of hotels use a CRS. But that's because it's mainly relevant for large establishments and chains. Smaller properties and independent hotels are more likely to manage without a CRS.”

Surprisingly, only 33% of hotels currently use a channel manager, while revenue management systems (RMS) are installed in only 28% of hotels. This means that many establishments still manually set and display their prices.

These are the technology solutions currently used most frequently by hoteliers.

Where are investments particularly strong?

The hotel industry has a reputation for being somewhat slow to adopt new technologies. But that changed during the pandemic. Since then, many hoteliers have increasingly addressed the issue.

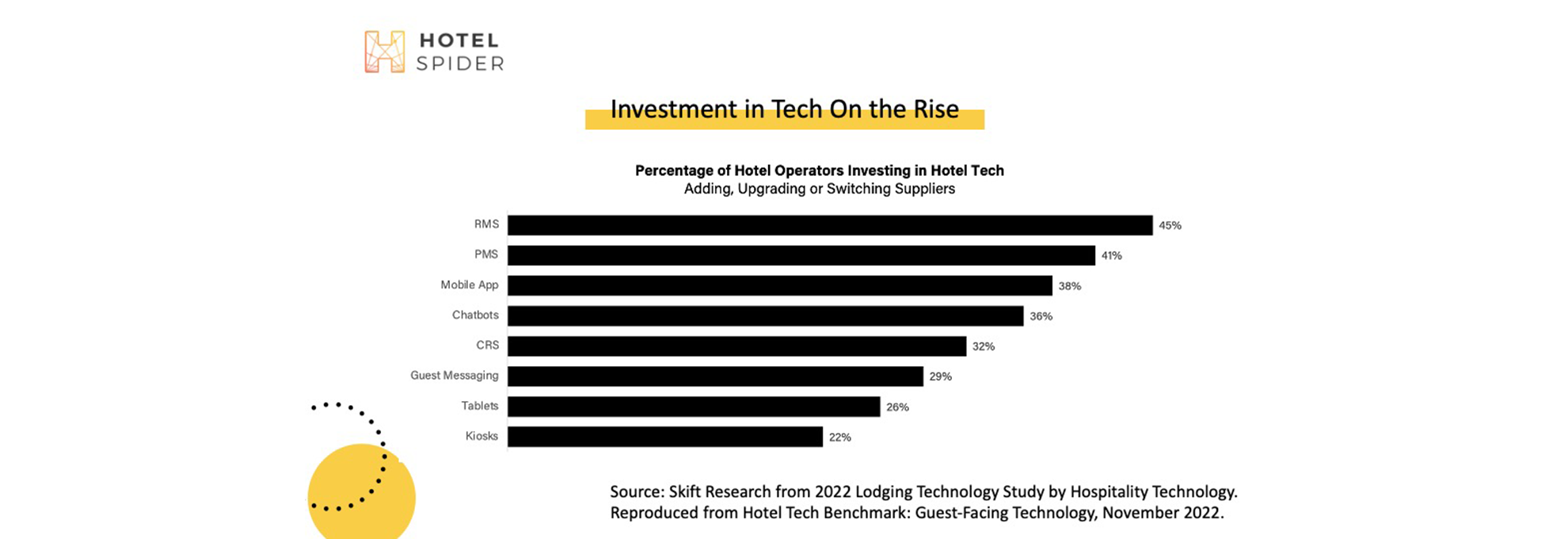

Hoteliers are currently investing particularly heavily in these solutions.

For example, Skift found that 46% want to change their RMS or implement a new one for the first time. Additionally, 41% say they are looking for a new PMS.

“Making changes is a big decision, especially with RMS and PMS. This often involves transitioning from legacy systems to cloud based solutions. This frequently involves a lot of work and a lengthy implementation process. You don’t make a decision like that lightly“, Marco interjects.

Along with administrative solutions, applications aimed at guests are also popular. These primarily include mobile hotel apps (38%), chatbots (36%) and guest messaging systems (29%).

“Hotels really need to be aware of what their guests actually want and need. Do these solutions fit the target group? Do they create real added value for travelers? These considerations are important to avoid bad investments and ensure that the hotel and its guests benefit equally from new applications,” adds Elisha.

New investment - yes or no? What often gets in the way

Implementing a new solution is often described by the provider as a simple, quick process. However, the reality is often different, depending on the program and requirements involved.

“Many hotels have programs installed on servers in the hotel and also store data on site. This can make it difficult to switch to new systems. That’s why we often wait until there is no other option and changing is unavoidable,” said Marco.

The cost of new technologies should not be neglected either. Many applications save money in the long run or help generate more sales. Nevertheless, a significant upfront investment is usually required, e.g. in the form of team training, implementation costs, etc.

Another challenge is when IT is handled internally, perhaps even by the operator itself. This is the case in 38% of hotels. If there is always a lot to do in everyday business, the introduction of new solutions will, for better or worse, be put on the back burner in order to take care of more urgent things,” says Elisha.

“Working with an external IT service provider can help here, but it doesn’t solve all of the problems. It often takes a long time for customers to get the answers or support they need. Nevertheless, important areas such as data protection and IT security should be looked after by experts. This could be an internal IT team or a reliable external partner,” Marco concludes.

As you can see, the DACH hotel industry is moving in a positive direction overall.

Demand has recovered since the pandemic and continues to look promising.

The increasing interest in new technology also shows that the industry is constantly evolving and is ready to adopt innovative solutions.

With new developments in the field of AI, things won't be boring in the future either. So one thing is clear: exciting times lie ahead!